Mobile MRI: Should You Rent or Buy?

A Strategic Guide for Imaging Leaders

Hospitals and imaging centers face a critical decision when expanding MRI services: is it better to rent a mobile MRI unit or purchase one outright? MRI is one of the most essential diagnostic tools in modern healthcare—with over 40 million scans performed annually in the U.S. As demand continues to grow, mobile MRI has become a compelling option to expand imaging access without the construction delays and costs of fixed suites.

Yet when it comes to capital planning, many hospital administrators are not primarily motivated by cost-cutting—they're focused on service continuity, patient throughput, and aligning investments with long-term growth. That’s why this guide reframes the rent vs. buy decision as a strategic investment opportunity: one that supports rapid deployment, operational flexibility, and scalable imaging programs.

Inside view of a mobile MRI trailer featuring a Siemens MRI scanner. Modern mobile MRI units are self-contained with a full-size magnet, delivering the same diagnostic performance as fixed in-house MRI systems. Mobile units can be driven to a site and set up quickly, providing advanced imaging capabilities wherever they’re needed.

Financial Models: Renting vs. Buying

From a budgeting perspective, renting is typically categorized as an operational expense (OpEx), while buying is a capital expense (CapEx). Renting offers flexibility: rapid access to imaging without the need for CapEx committee approvals, preserving capital for other mission-critical projects. Maintenance, support, and compliance services are often included—simplifying management and reducing downtime risk.

Ownership, on the other hand, becomes advantageous in high-volume environments. It’s not solely about long-term savings—it’s about building equity, creating consistency in protocols, and maximizing reimbursement efficiency.

Average reimbursement per MRI scan in the U.S. is around $550 (this can vary by payer and facility type), so a quick calculation can estimate revenue versus costs under each model. Below, we’ll explore scenarios for a small clinic, a medium hospital, and a large system, to illustrate how the rent vs. buy decision might play out in each case.

Consider this:

One hospital study found that an MRI program needed to perform ~203 scans/month to break even—but was only performing ~138. Until volume ramped up, each scan operated at a net loss. Flexible options like short-term rental or rent-to-own provided a path to scale without overcommitting capital.

Note: Service & Maintenance costs for purchased Mobile MRI typically covers the MRI unit and trailer.Additionally, technologist staffing costs can vary significantly based on geographic region, availability, and shift structure. These costs should be modeled separately based on your facility’s local labor market and operational plan.

ROI by Facility Volume

Whether you’re serving a small clinic or a large hospital network, the right mobile MRI strategy depends heavily on patient volume, reimbursement, and long-term goals. Below, we outline four common facility profiles and their financial implications—highlighting how scan volume influences rental vs. ownership decisions:

Small Volume Facility (~50 scans/month)

~$330,000 in annual MRI revenue

High capital investment makes ownership difficult to justify

Rentals provide access to imaging with no CapEx and scalable scheduling (e.g., 1–2 days/week)

Supports patient care continuity while avoiding outside referrals

Mid-Sized Hospital (~200 scans/month)

~$1.32 million in annual MRI revenue

At this volume, either model can make sense depending on capital availability

Rent-to-own may be ideal: start with low-risk rental and convert to ownership when volumes stabilize

High enough utilization to support ongoing profitability

Large Hospital System – Tier 1 (~500 scans/month)

~$3.3 million in annual MRI revenue

Ownership becomes increasingly favorable with stronger ROI potential

Renting may still be used to manage seasonal spikes or cover specialty service lines

Scalable operations allow for deployment across departments or outpatient centers

Large Hospital System – Tier 2 (~1,000 scans/month)

~$6.6 million in annual MRI revenue

Ownership model delivers substantial margin, with break-even in under 2 years

Mobile MRI units may serve as overflow support, satellite expansion, or during construction

Delays in capacity expansion could represent significant opportunity cost—making short-term rentals a justified stopgap

ROI Summary by Volume: Rent vs. Buy Scenarios

To summarize the financial comparison, the table below provides an illustrative ROI analysis for small, medium, and large facility volumes. It outlines potential revenue and costs, highlighting how the break-even dynamics change with scale:

Notes: Estimated costs are simplified for illustration. “Ownership cost” assumes financing a ~$1.5M unit over several years plus maintenance; actual figures will vary. In practice, staffing and reading costs apply to both models equally and are not shown here. Each facility should perform its own detailed ROI analysis with real quotes.

As the table suggests, scale is decisive. Small volumes rarely cover the fixed costs of owning an MRI, so renting or sharing a mobile unit is often the prudent choice. Medium volumes sit near the typical break-even point – making the decision more nuanced, based on financial flexibility and growth plans. Large volumes overwhelmingly favor purchasing, although strategic rentals can still complement the service portfolio.

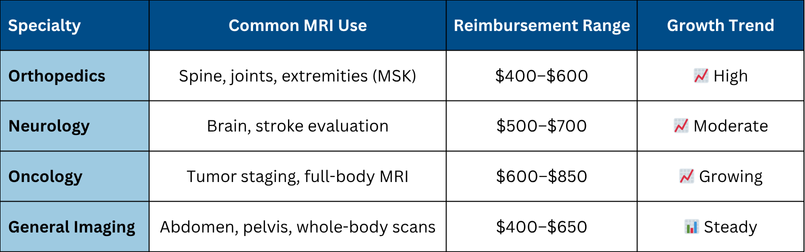

Clinical Use Cases Driving Mobile MRI Demand

Financial considerations aside, it’s important to recognize the clinical drivers behind MRI adoption. MRI is a uniquely versatile imaging modality, and a mobile MRI unit can significantly enhance a hospital’s service lines. Key use cases include:

Orthopedics: The top referral source for MRI. Imaging for joint, spine, and soft tissue conditions drives consistent volume. Mobile MRI supports orthopedic clinics, sports medicine, and post-op evaluations—without requiring fixed suite expansion.

Neurology & Spine: Stroke protocols, neuro-oncology, MS, and spine disorders all rely on MRI. Mobile deployment allows facilities to add or redirect advanced neuroimaging access to where it’s most needed.

Oncology & Whole-Body Imaging: Oncology centers use MRI for staging and treatment planning. Some institutions use mobile units to provide periodic whole-body MRI days or cancer-specific protocols.

Specialty Clinics: Spine centers, pain management, and multi-specialty hubs can integrate a mobile MRI to elevate their care offering, retain patients, and control imaging quality.

Advances in MRI Technology in Mobile Units

MRI technology has advanced dramatically over the past couple of decades, and modern mobile MRIs keep pace with the latest innovations. Earlier generations of mobile MRI units often housed older 1.5T magnets with smaller bores and basic coils; today, you can find state-of-the-art systems installed in trailers. Key advances to be aware of include:

Wider Bore Sizes: Most new MRI systems feature wide-bore designs (typically ~70 cm diameter openings) compared to the 60 cm bores of older machines. This larger bore is a game-changer for patient comfort – it can accommodate bariatric patients more easily and reduces claustrophobia for everyone. Patients who might otherwise refuse or require sedation for MRI due to claustrophobia can tolerate a wide-bore scanner. For mobile units serving diverse communities, having a wide-bore MRI greatly expands the patient population that can be imaged. The trailer itself is engineered to house these larger magnets (sometimes using specialized “extra-wide” trailers), so mobile doesn’t mean compromising on patient aperture or comfort.

Increased Channels and Higher Field Strength: MRI “channels” refer to the number of independent signal receivers (coil elements) used to capture data. More channels generally enable higher-resolution images and faster scanning through parallel imaging techniques. Older mobile MRIs often featured 4, 8, or 16 channels, while newer units now offer 32, 48, or even more—paired with digital signal processing for clearer images and advanced imaging capabilities.

As for field strength, 1.5 Tesla remains the standard in mobile MRI due to its balance of power requirements, diagnostic capability, and trailer limitations. While 3.0 Tesla MRI systems offer higher signal strength and are valuable for applications like neuro and cartilage imaging, they are not currently feasible in traditional mobile MRI trailers.

That said, some healthcare systems choose to install 3.0T MRIs in larger modular or transportable 12x60 trailers, which can function as semi-permanent units. These require significant infrastructure (such as enhanced lead shielding and specialized power systems) and are better suited for long-term setups rather than true mobile deployments. For most hospitals using a mobile MRI program, 1.5T systems continue to provide excellent diagnostic quality across a broad range of applications.

Metal Artifact Reduction (MAR): Patients with metal implants (hip/knee replacements, spine hardware, dental work, etc.) have long been difficult to image with MRI due to severe distortion artifacts. New metal artifact reduction sequences (such as GE’s MAVRIC or Siemens’ SEMAC technologies) have vastly improved the MRI image quality around metal. These techniques use special 3D acquisitions to suppress the warping and voids that metal can cause in images. The result is that orthopedic patients with joint replacements, for example, can be effectively scanned to evaluate the surrounding soft tissues or check for complications. Mobile MRI units equipped with modern software can leverage MAR sequences to expand their service – making them useful for imaging post-operative orthopedic cases that earlier MRI systems could not adequately handle. For a hospital with a large orthopedic program, having MAR capability in a mobile MRI is a significant clinical advantage.

Table: Key MRI Technology Evolution in Mobile Systems

Advancements in AI: Elevating Mobile MRI Performance

Recent innovations in artificial intelligence are transforming how hospitals approach mobile MRI, offering faster scan times, enhanced diagnostic clarity, and streamlined workflows:

AI-Based Image Reconstruction: Tools like GE’s AIR Recon DL, Siemens’ Deep Resolve, Philips SmartSpeed, and Canon AiCE improve image quality while significantly reducing scan times—up to 30% faster in many cases.

Increased Patient Throughput: Faster scan protocols and AI-driven automation can enable mobile units to handle more patients per day, maximizing return on investment and reducing scheduling bottlenecks.

Workflow Automation: AI now assists in slice positioning, protocol optimization, and image post-processing, reducing tech time and improving consistency.

Improved Diagnostic Confidence: AI-enhanced images reduce noise and highlight subtle findings, which can lead to earlier and more accurate diagnoses.

Table: AI Enhancements Mobile MRI

These tools, once limited to fixed-site flagship scanners, are now integrated into mobile configurations—ensuring that portability doesn’t mean sacrificing innovation.

Financial Outlook: Scan Volume vs. Profitability

Table: ROI Scenarios by Monthly Volume

💡 Estimates based on $550 average reimbursement per scan. Ownership models assume 5-year amortization and annual service costs. Additionally, technologist staffing costs can vary significantly based on geographic region, availability, and shift structure. These costs should be modeled separately based on your facility’s local labor market and operational plan.

This visual highlights how ownership becomes more profitable as volume increases, while rentals provide faster access and easier entry for low-to-mid volume sites.

Final Thoughts: Strategic Fit & Flexibility

Whether your goal is to fill a short-term gap, scale service lines, or transition to asset ownership, the mobile MRI model offers multiple entry points. Renting creates optionality. Purchasing captures margin. Rent-to-own aligns cash flow with growth.

The key is not just cost—but control, continuity, and the ability to adapt. USA Mobile Medical works with hospitals of all sizes to evaluate reimbursement projections, volume forecasts, and strategic timelines.

Table: Strategic Use Cases

✅ Mobile MRI rentals work well for:

Short-term needs (pilot programs, construction bridges, seasonal surges)

Budget-constrained hospitals

Outreach into rural or low-access communities

✅ Purchasing a mobile MRI system is ideal for:

Stable, high-volume hospitals (200+ scans/month)

Facilities looking for full control and long-term cost efficiency

Systems building a regional MRI hub

How USA Mobile Medical Can Help

At USA Mobile Medical, we help facilities like yours forecast volumes, assess ROI, and plan for sustainable growth. From short-term rentals to rent-to-own programs, our team can guide you to the right path—so you can focus on delivering care, not crunching numbers.

Whether you're launching a program or expanding one, USA Mobile Medical offers both rentals and full equipment sales:

Short- or long-term use

Full-service support and installation

Flexible access to GE, Siemens, Canon, and Philips technology

New and refurbished systems

Project planning and install support

Service and warranty options available

📞 Ready to talk?

Let’s build a mobile MRI program that delivers better care—and better returns.

Sources: